child tax credit december 2021 payment date

17 is an important deadline for millions of Americans who may still need to claim stimulus checks and. Taxpayer income requirements to claim the 2022 child tax credit.

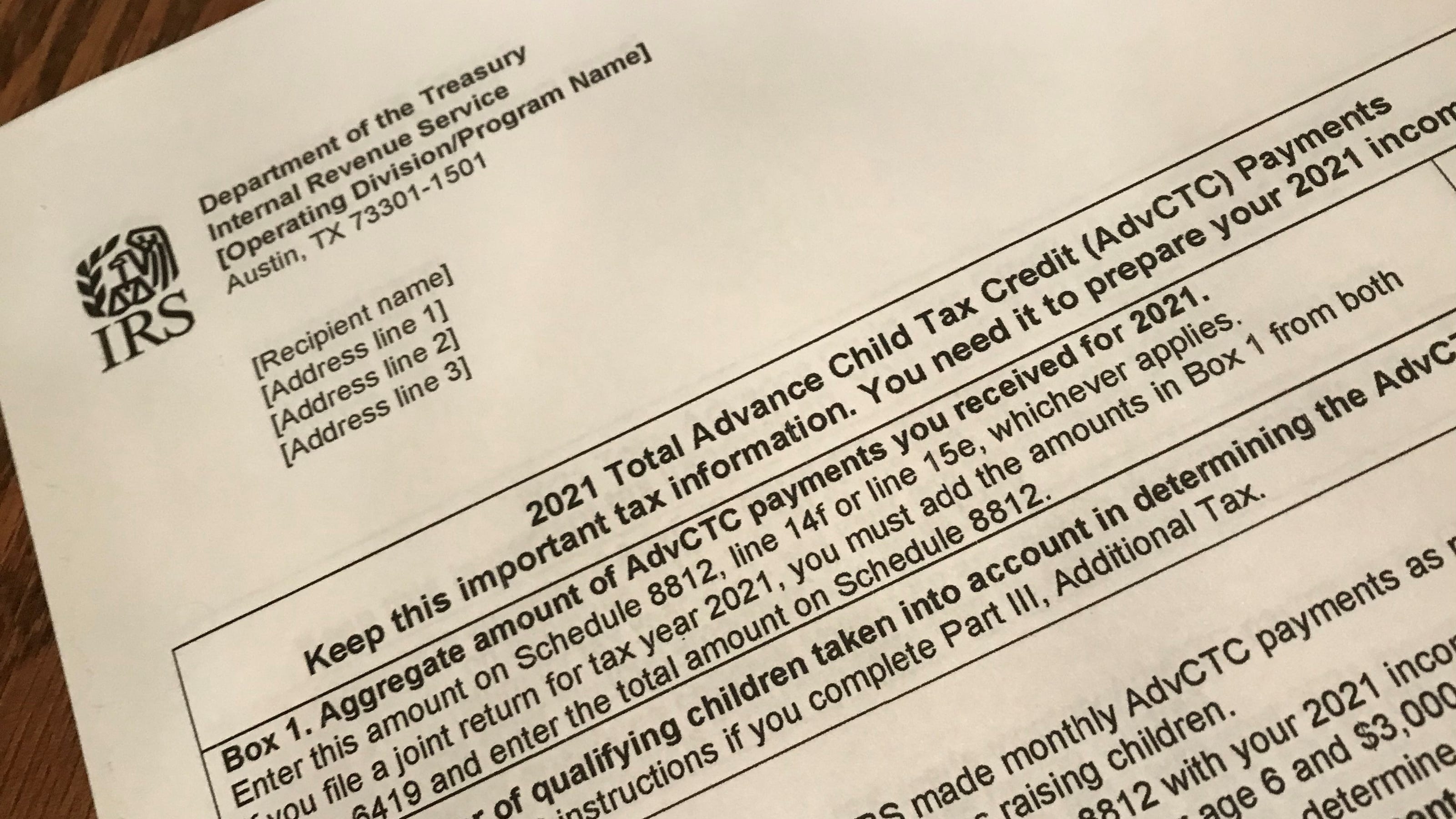

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wset

The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers.

. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Up to half of those amounts were paid in advance through. The credits scope has been expanded.

The IRS sent six monthly child tax credit payments in 2021. However the deadline to apply for the child tax credit payment passed on. Goods and services tax harmonized sales tax GSTHST.

Canada child benefit payment dates. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. 3 January - England and Northern Ireland only.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. December 13 2022 Havent received your payment. To approximately 36 million families on December 15.

Previously only children 16 and younger qualified. The 2021 child tax credit payment dates along with. 28 December - England and Scotland only.

Here are the official dates. The payments will be made either by direct deposit or by paper check depending on what. Lets condense all that information.

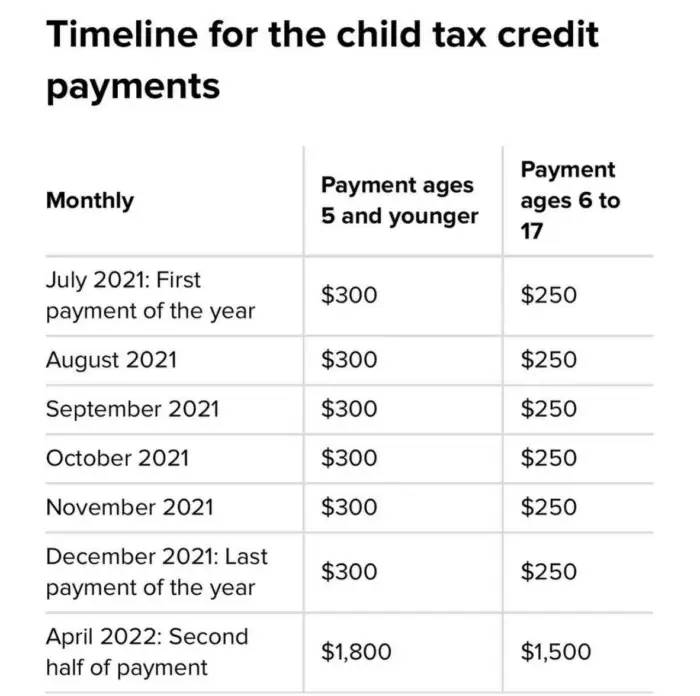

Last day for December payments. Enhanced child tax credit. Advanced payments of the 2021 CTC will be made monthly from July through December to eligible taxpayers starting July 15.

For 2021 the credit amount is. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes. Will they send any more in 2022.

Child Tax Credit dates. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. The CRA makes Canada child benefit CCB payments on the following dates.

Wait 5 working days from the payment date to contact us. If your payment is. This means that the total advance payment amount will be made in one December payment.

Understand that the credit does not affect their federal. Claim the full Child Tax Credit on the 2021 tax return. The advanced payments will be up to 50 percent of the.

The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. The child tax credit included up to 3600 for children under age 6 and 3000 per child ages 6 through 17.

Understand how the 2021 Child Tax Credit works. The IRS pre-paid half the total credit amount in monthly payments from. Find out if they are eligible to receive the Child Tax Credit.

Child Tax Credit dates. 757 AM CST November 17 2022. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Get the Child Tax Credit. Opting out of one months payment will also unenroll you from future payments. 1200 sent in April 2020 Second.

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Child Tax Credit 2021 Payment Dates Youtube

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

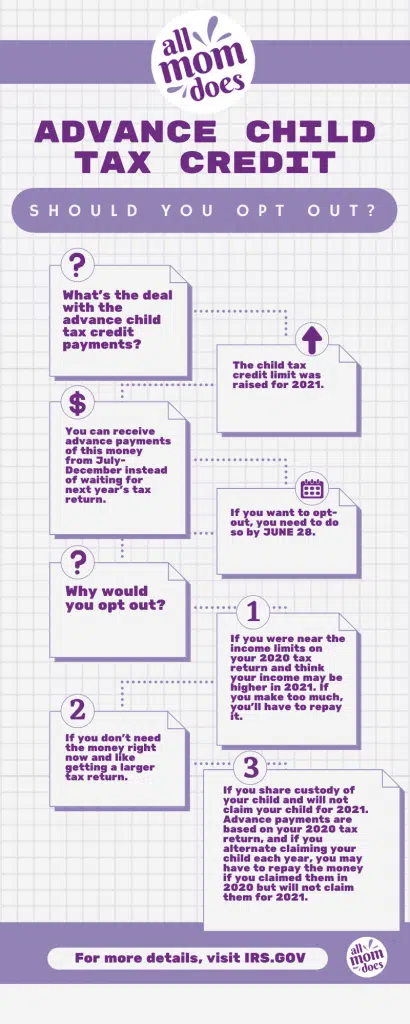

Should You Opt Out Of The New Advance Child Tax Credit Payments Here S What You Need To Know Allmomdoes

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

What Families Need To Know About The Ctc In 2022 Clasp

Dates For The Advanced Child Tax Credit Payments

Child Tax Credit Payment Schedule For 2021 Kiplinger

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

About The Child Tax Credit Momsrising

Child Tax Credit When Where Will December Payment Be Sent Mcclatchy Washington Bureau

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Some Families Missing Out On Child Tax Credit

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep